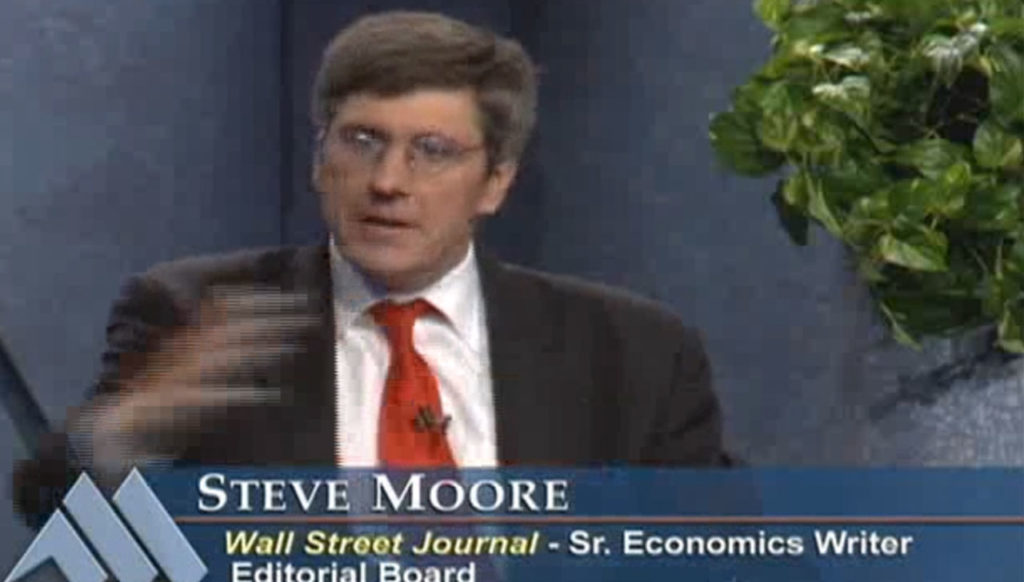

On this program Stephen Moore joins Dennis McCuistion to discuss the shift from free trade to fair trade and the implications of the weak dollar. He touches on the concern over China, Japan and countries in Middle East holding portions of the American national debt. Stephen Moore is an economist and the Senior Editorial Writer for the Wall Street Journal.

The international economy is more competitive than it has been in the last 20 years. Moore spends time discussing the importance of the tax plans in relation to the US economy and in keeping the US economy competitive with the international economy. He goes into detail mentioning corporate tax, fair tax, death tax, estate tax, income tax, state tax, etc.

In discussing fair trade versus free trade, Moore contends for free trade as it holds down prices on things that are globally traded, thus keeping the prices down.

The implications of foreign countries funding the American debt is discussed in detail. Foreigners have had confidence in the US economy for years, thus trillions of dollars in foreign investments are a part of our national debt. If foreigners were to choose to switch to another currency, we could be in a serious crisis.

Guest, David Walker, former Comptroller General of the United States, offered his viewpoint on where the nation stands economically in regards to the weak dollar. Moore follows his comments discussing the need for the U.S. to lesson off-shore oil drilling and take advantage of national resources.

They end the discussion stating that no country as ever gotten rich by devaluing their currency. Poor government policies have an affect on consumers, multi-national corporations and the world.

***

1712 – 11.23.08