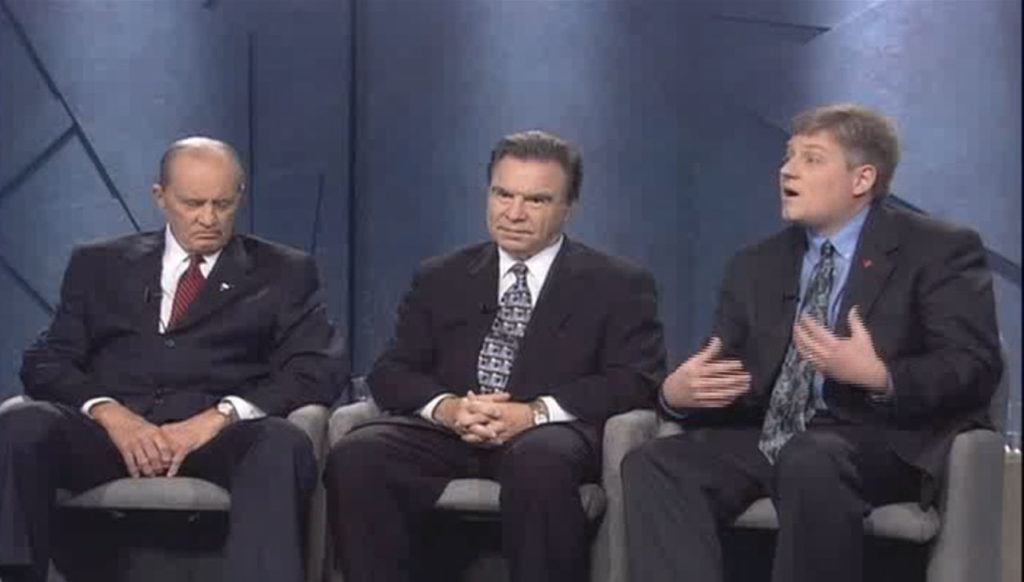

The present mortgage market, which includes, experts say, $100 billion dollars in subprime lending may lead to a wide disruption of financial markets, lack of liquidity, jobs and corporate profits. In this segment, the panelists discuss how this was caused and how it will affect the average person and business owner. The panelists include:

- Mike Davis, Professor of Economics and Finance, Southern Methodist University – Cox School of Business

- John Heasley, Executive Vice President, Texas Bankers Association

- Bob McTeer, Ph.D, Distinguished Fellow, National Center for Policy Analysis

- Dory Wiley, CPA, President, Commerce Street Capital

The housing market is in turmoil and the credit crunch has drastically effected the American economy and the overall feeling of personal financial stability. Explaining the reasons for the credit crunch, panelists cite housing interest rates, accessibility of mortgages and lack of equity, just to name a few. The Fed has had a role in the crisis of the day, but they contend that the Fed is not the primary player in the current credit crunch.

During their discussion of who is to blame for the credit crisis, they discuss subprime lending and securitization. Subprime lending and securitization are not bad in themselves, however, in excess they became very dangerous.

In a video with Fred Foldvary, Ph.D., economist from Santa Clara University, Foldvary forecasts a depression in 2008 or by end of the decade and explains his reasons why.

The discussion concludes with the panelists discussing ways to recover and safeguard for the future.

***

05.04.08 – 1703