Alternative lenders such as payday and title lenders and pawnshops are under scrutiny by several city legislators around the country. There are those who say that these lenders provide a needed service and others who say that some lenders misrepresent the contract, charge exceptionally high interest, and make it almost impossible for borrowers to get out of debt. Some of the charges passed on to consumers are labeled as fees, rather than interest, so the charges are complex and may make the loan even more costly. Are these loans worth the costs, and how should these lenders be regulated?

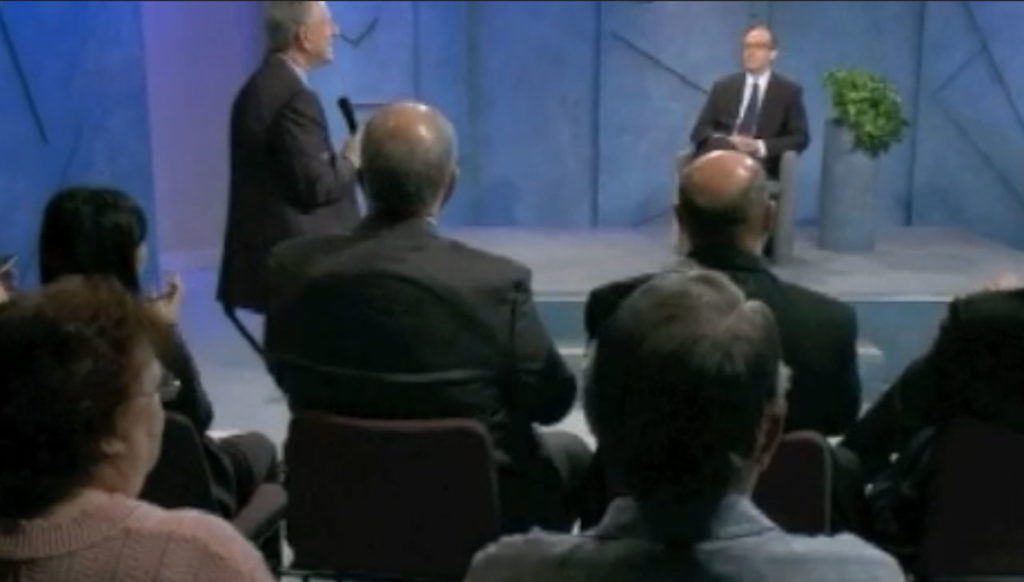

Joining host, Dennis McCuistion, are:

- Anne Baddour: Senior Policy Analyst at Texas Appleseed

- Rob Norcross: Consumer Service Alliance of Texas

- Rev. Gerald Britt with City Square

Both payday and title loan lenders agree that consumers need to be better educated and make the choices that will allow them to be debt free.

This program explores why people go to payday lenders, the complexity of the issue and the legislation in question.

Join us as once again we talk about things that matter… with people who care.

Niki Nicastro McCuistion, CSP

Executive Producer/ Producer

Management Analyst, Speaker, Consultant

nikin@nikimccuistion.com

(214) 394-6794

***

2007 – 11.11.12